Shadow of sequestration hovers over IT market forecast

The Defense Department, beset by flat spending and budget cuts, leads the way in dampening industry group's market outlook.

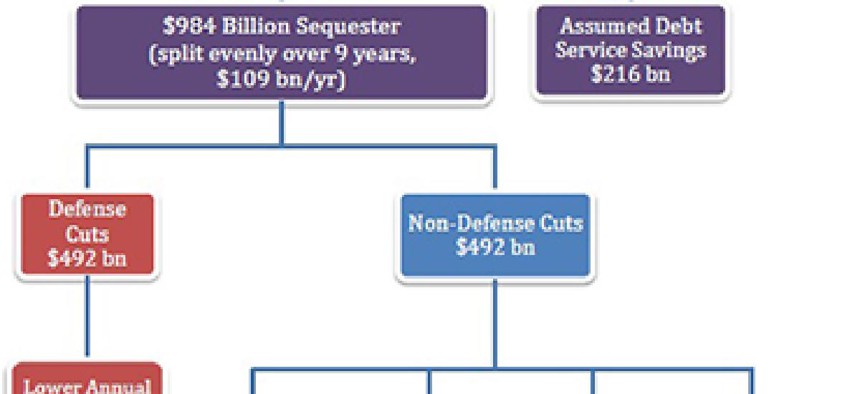

A breakdown of the cuts mandated by the Budget Control Act, as illustrated by the Bipartisan Policy Center. TechAmerica's forecast suggests there are several possible scenarios for how sequestration could unfold.

Federal IT is bogged down by ominous macroeconomic trends, weak economic recovery and volatile policy-making, making the forecast over the next few years less than encouraging, according to industry experts.

The Defense Department is particularly hard-hit by flat spending, mired in competing contingencies, a military drawdown and massive budget cuts. A new forecast from the TechAmerica foundation predicts DOD topline spending will stay in real decline through fiscal 2017, down 30 percent from 2007 peak wartime spending of roughly $730 billion.

With additional pressures from budget uncertainty under Congress’ continuing resolutions, the possibility of sequestration’s across-the-board cuts and changes in military strategies, there is a pervasive sense of ambiguity looking forward. It’s unclear if DOD will face cuts in the tens of billions or in the hundreds of billions, TechAmerica representatives noted.

“The Middle East, cybersecurity threats, defense investments and procurements and what kind of weapons systems will be bought in the future, sequestration, the drawdown, the Asia-Pacific pivot and its necessary buildup of the Navy in that part of the world – all of these are factors in what these numbers look like, and a variation in any one of them could change the outcome,” said Trey Hodgkins, TechAmerica senior vice president of global public sector.

One of the biggest budgetary question marks hovers over sequestration. If enacted as currently planned, it would slash more than $1 trillion in government spending over the next 10 years, with DOD taking a large share – including $56 billion in fiscal 2013.

According to TechAmerica, there are several scenarios seen as possibilities of how sequestration could unfold. According to the group’s findings, the mostly likely would not be a sequestration at all, but a bipartisan solution that would implement a mix of tax and spending changes that would allow discretionary cuts to be deferred to out years, Hodgkins said.

“We anticipate a sequestration-like cut, but it’s going to involve Congress and the next President coming together and resolving it in a political fashion,” he said. “I think it tracks the conversation we’ve been seeing about trying to avoid the effects of sequestration in the short term with a short-term political solution followed by a long-term political solution, and that’s what the numbers also tell.”

The broader federal IT market over is predicted to stay flat as well, though the civilian IT market may see slight increases – growth around 1.2 percent – through 2018, according to TechAmerica spokesman Robert Haas.

Continuing resolutions, sequestration and fiscal cliff worries and political gridlock all are putting IT growth on ice, Haas said, but he added that budget cuts are not the only factor constraining federal IT and its economic outlook.

The government currently faces a period of IT transformation – something he said happens about every 15 years – that is requiring a shift in technology, business processes and the federal workforce. But with anemic funding, the transformation is undergoing serious challenges.

“One of our interviews suggested that we wouldn’t see an increase in the IT budget until we saw the GDP tick above 3 percent…that’s taking into account all of these economic factors,” Haas said. “The government is really at a crossroads with a number of different factors…there’s a major IT transformation of mobile, cloud and virtualization. It’s a major tech shift, but the government hasn’t had ability to invest to make those changes.”

Money is not the only problem, Haas added. Internal governance and policies – both in the leadership and in IT systems – are presenting agencies with even more hurdles.

“CIOs that are executing these IT budgets really don’t have budget authority; it still rests with CFO. That split authority really constrains their ability to execute. In some cases that might be good, forcing them to work together…in other cases it’s not working well,” he said. In terms of IT systems, “simply automating what you’ve got, without changing the way you do work or change the outcomes, isn’t going to be that valuable. There’s a business processing reengineering component that’s needed to really make the investments pay off.”

Still, there are some bright spots. Consolidation and transformation as well as cybersecurity, while challenging, are receiving some funding and present opportunities, Haas and Hodgkins said. Data center consolidation, virtualization, cloud transitioning, business process reengineering and enterprise infrastructure all are hot areas in both the civilian and military IT markets.

At DOD, the transformation is central as the military shifts out of Afghanistan and into modernization.

“What we’re seeing with the infrastructure side of things that you’ve got to have that investment before you can support the mobile warfighter in the field. That’s really the driver…since DOD is shifting to more of a mobile warfighter,” Haas said. “They have people deployed in the field who need to be able to reach back into their base camp or station to access data, and it needs to be available on the network [at all times]. None of that’s possible unless you have the infrastructure.”

NEXT STORY: DOD requires faster payments to subcontractors