SEWP: An acquisition pioneer is still going strong

Protests have delayed SEWP V, but industry experts say the contract vehicle offers agencies service and value that are hard to find.

What do NASA's Solutions for Enterprisewide Procurement program and the Mars rovers have in common? More than you might think.

Many recall NASA's Spirit and Opportunity rovers, which launched in 2003 with a tightly focused, 90-day mission yet continued to explore the red planet for years. The agency's SEWP contract is far less famous, but it too was launched with a smaller, more focused job in mind -- and that was more than 20 years ago.

The multiple-award, indefinite-delivery, indefinite-quantity (IDIQ) governmentwide acquisition contract (GWAC) has been a pioneer in its own right and has proven durable and effective well beyond its initial expiration date.

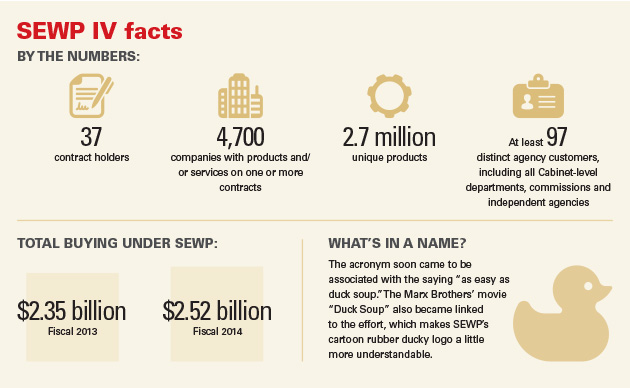

The program was authorized in 1993 by the Office of Management and Budget to help the agency buy computers more effectively. The acronym originally stood for Scientific and Engineering Workstation Procurement, and the contract provided technical and engineering-related IT products but not associated services. The acronym changed to its current form in 2007 after computer technology blossomed and firm-fixed-price services became available.

SEWP is now in its fifth iteration. Under the contract vehicle, all federal agencies can buy IT products, including tablet and desktop computers, servers, peripheral devices, network equipment, storage systems, security tools, software, cloud-based services and videoconferencing systems. They can also get training, maintenance and installation services.

Even after 22 years, analysts say, SEWP still matters to federal IT buyers because it fills a critical need. Agencies have access to a reliable source of a wide range of products gathered in one place where they can pick and choose what they want, and it's all backed by scrupulous customer service.

"SEWP is the leader in the GWAC space," said Erica McCann, director of federal procurement at the Information Technology Industry Council's IT Alliance for the Public Sector. SEWP's top management "has a refreshingly nongovernmental take" on IT acquisition, she added, and instead of acting like a large federal bureaucracy, SEWP behaves more like a small business that is determined to get and keep its customers' business, making it a standout for federal users.

SEWP Program Manager Joanne Woytek said other GWACs, such as the General Services Administration's Alliant and the National Institutes of Health IT Acquisition and Assessment Center's contracts, tend to be more services-oriented.

Nevertheless, SEWP does have some overlap with the other GWACs, and all the programs share a common goal of reducing the thousands of agency-specific contracts that can bog down federal operations.

"All three agencies are more concerned with the continued proliferation of non-GWAC contracts and the even larger use of open market purchasing than about GWAC competition," Woytek said. "We each have our own strengths and provide the government with a well-established set of options that agencies can select from based on their particular needs."

A contentious market

After two decades of successful service, however, SEWP faces some challenges as the federal IT market and the federal acquisition world change dramatically.

"The key challenge is the introduction of the SEWP V contracts," Woytek said. "We will more than double in size in terms of number of contracts." SEWP V will have more competition, important contract-tracking options and other improvements, but the agency will have to retool its internal processes to manage the new contracts, she added.

Alan Chvotkin, executive vice president and counsel at the Professional Services Council, said that as the SEWP V contracts take shape, vendors are feeling the effects of agencies' budget constraints. Because agencies have less money to spend, it is imperative for technology resellers and manufacturers to be included in large GWACs and other IDIQ contracts so they can show off their wares in as many places as possible. That's not easy or inexpensive, he added.

Partly as a result of those pressures, bid protests have become a significant part of the federal acquisition process, Chvotkin said. "The larger the opportunity, the greater value to the incumbent" providers -- and the harder they fight.

That pressure was evident in November when NASA decided to re-evaluate dozens of contracts it had awarded under SEWP V in response to protests. On Oct. 1 and Oct. 15, NASA had approved 73 contracts for hardware, software and related services in three categories based on company size. Protests started almost as soon as the contracts were announced, with 17 firms filing in various categories.

As a result, the agency extended SEWP IV until April as it works through the SEWP V protests. NASA officials have also made some efficiency improvements to SEWP IV operations and lowered the fee built into product prices from 0.45 percent to 0.39 percent.

SEWP's situation isn't unique in the current contentious market, McCann said. Companies "are scrapping about where they are" on federal contracting vehicles overall.

Woytek said GWACs are no more susceptible to protests than any other federal contract, and Chvotkin agreed that there's no reason to expect SEWP V to be hit by more protests. Ultimately, "it's up to the agencies to get [contracting vehicles] right," he said, adding that SEWP V might have an advantage because its creators included vendors in the development process.

The impact of strategic sourcing

Another potential hurdle for SEWP is the growing influence of GSA's efforts at strategic sourcing, which include detailed, price-oriented category management. GSA has been steadily building detailed product "hallways" where federal IT buyers can find details about specific applications, products and, perhaps most important, prices other agencies paid for the same or similar equipment and services.

GSA officials hope to bolster the agency's standing as the default source for federal IT managers looking for solutions. The agency also has its own GWAC and the Schedule 70 IDIQ, which is the most widely used acquisition vehicle in the federal government.

GSA's efforts to build information on product categories do not necessarily come at the expense of other GWACs because GSA officials have said they want to include information on all federal GWACs.

In fact, McCann and Chvotkin said GSA's efforts will probably aid SEWP. "Category management hallways will bring more visibility to a host of IDIQ GWACs, including SEWP," Chvotkin said.

He and McCann agreed that SEWP will almost certainly endure. The GWAC continues to respond to the marketplace and federal users' demands, McCann said, and Woytek "knows how to adapt to changing needs."

McCann also credited Woytek with creating a culture of scrupulous customer service that has built a loyal following among federal buyers. "That's something you don't see in government every day," she said.

NEXT STORY: The right tool for the job