IRS promises nationwide electronic filing

The IRS' e-file pilot program in 1986 became a test case for the technology of electronic filing and the information policies governing its uses.

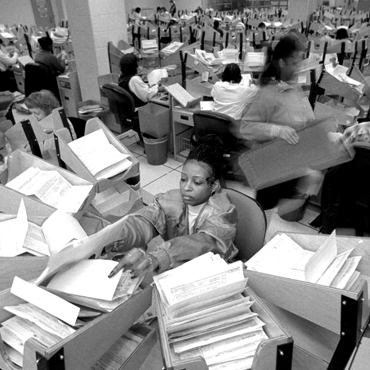

Processing paper returns at IRS.

A catalyst for the government's transition from paper to digital documents in the 1990s was the electronic filing of tax returns, an IRS project that touched the financial interests of all American taxpayers.

The IRS' e-file pilot program in 1986 became a test case for the technology of electronic filing and the information policies governing its uses.

Taxpayers and preparers alike quickly took to the program.

In June 1987, 78,000 tax returns from 47 preparers were filed electronically, according to the IRS. By 2011, the program had crossed the 100 million mark in one filing season and racked up 1 billion electronic returns over the life of the program.

The success of e-filing helped lay the foundation for efforts in the 1990s and 2000s to develop electronic government services that could be offered or accessed via the web -- ranging from applying for a passport to bidding on a federal contract.

Over time, the IRS introduced features to smooth the customer experience. In 2002, the agency added the option of using a PIN to help authenticate tax documents, a shortcut that ultimately eliminated the need for written signatures and paper returns. A year later, the agency stopped mailing paper tax forms altogether after enabling users to download the necessary documents online.

Later, an upgrade of e-file -- Modernized e-File -- adopted XML to streamline the digital formatting necessary for publishing documents on the web.

That digitization came with downsides, however. No analog identity thief would have had the truck space to haul away the 700,000 taxpayer records that hackers accessed in 2015 (though that breach involved an IRS system that did not rely on PINs).

And the boom in electronic systems and services brought new complications to the agency's obligation to manage and preserve digital files -- challenges that every agency now faces. Last year, the (then) National Archives and Records Administration's chief records officer, Paul Wester, was asked how agencies should handle content from Facebook, Twitter and other new platforms generated in the course of agency business.

"Such records are federal records that should be retained in formats that can be electronically retrieved," Wester said at an industry conference. "Some of this content can have permanent value at the highest level of your agency."