IRS considers future of Direct File pilot

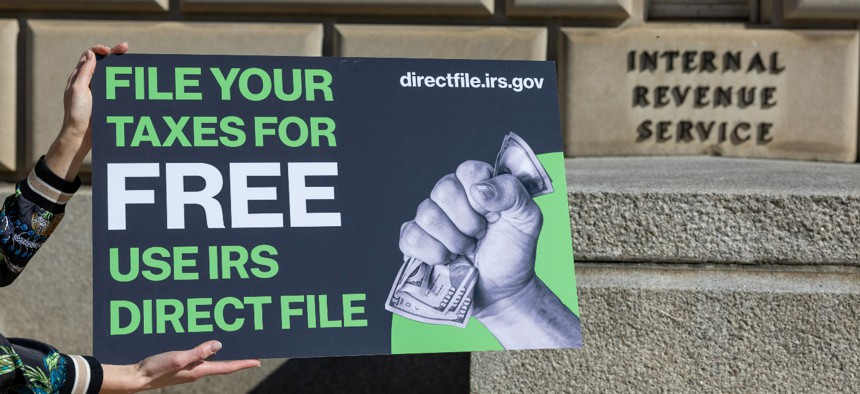

Tasos Katopodis/Getty Images for Economic Security Project

The agency hasn’t decided if it’ll field the program long term but does say that user feedback of the tool has largely been positive.

The IRS hasn’t made a decision about whether it will field its Direct File platform long-term, Commissioner Danny Werfel says, but the tax agency is touting positive user ratings for the tool, which offered Americans with simple tax situations in 12 states a way to file their federal taxes online with the IRS for free.

“Above all, our goal was to make a product that worked,” said Werfel. “And the bottom line — Direct File worked.”

The pilot dates back to the 2022 Inflation Reduction Act, which directed the IRS to study the feasibility of such a system. The Treasury Department and IRS then opted to pilot the system this tax season.

In total, 140,803 individuals used Direct File to successfully file their tax returns, a number the IRS says exceeded expectations for an intentionally limited pilot that became more widely open to users in mid-March after limited testing.

Over 3.3 million taxpayers started the eligibility checker included at the beginning of the Direct File tool, according to the IRS.

Users claimed over $90 million in refunds and saved an estimated $5.6 million in tax prep fees on their federal returns, Deputy Treasury Secretary Wally Adeyemo said in a Friday call with reporters.

“Direct File not only saved people money, not only saved people time, but helped people have a good experience with the IRS,” he said. “Because ultimately, our goal is to make sure that the IRS works for the American people.”

Of the over 11,000 who took surveys about the product, 90% rated their experience as “excellent” or “above average.”

The pilot, offered in English and Spanish, was meant as an option for those with simple tax situations to file federal returns in 12 states that either had no income taxes or were offering a free, state-backed tool for users to finish their state returns.

The IRS also used the pilot to test a live-chat feature. Again, 90% of those surveyed rated customer support as either “excellent” or “above average.”

Foundational tech and product development costs for the tool came in at $10.5 million, and operational costs like customer service and user authentication at $2.4 million.

In total, the pilot cost $24.6 million, including the report to Congress, according to the IRS, although back-end work to modernize legacy systems also contributed to the pilot and other IRS products, a senior Treasury official told reporters.

The cost is significantly under budget compared to what was expected, a senior IRS official told reporters. The IRS got the help of other tech teams in government to build the tool, including 18F and U.S. Digital Service, although the latter did not cost the IRS any money, the tax agency says.

Now, the IRS is analyzing data and meeting with partners and stakeholders to get feedback and make a decision about the fate of the program this spring, said Werfel. A more detailed report on the pilot will be released soon, he said.

Asked if the looming election will play a role in the decision, the senior Treasury official told reporters, “Not at all. Our goal... is to do what’s in the best interest of taxpayers.”

Some Republicans on Capitol Hill came out against the pilot, calling it “a way to expand the power of the IRS that no one asked for” and questioning if the agency needed additional authorization from Congress for the program, something the IRS commissioner has previously stated is not necessary.

If the IRS does move forward with Direct File, the existing platform can be updated to reflect potential future tax law changes quickly, said Werfel. The IRS could expand the number of states that offer the tool or the scope of the tax situations covered by Direct File.

The tax agency has long relied on a partnership with private tax prep companies, dubbed Free File, to offer most Americans a free way to file their taxes online, although it’s largely been vastly underutilized.

“100% of Americans can already file their taxes completely free of charge, free to the government and actually free to taxpayers,” Rick Heineman, Intuit spokesperson, told Nextgov/FCW in a statement.

A tax prep software coalition, called the Coalition for Taxpayer Rights, called the pilot “costly, confusing and completely unnecessary” in a statement earlier this month.

The same coalition has previously pointed out that the 100,000 plus users who filed with the system are among 19 million who were eligible for the pilot, per the IRS.

That 19 million number accounts for all those eligible from the start of the tax season, a Treasury official told Nextgov/FCW, although the pilot only opened widely in mid-March, a point at which many taxpayers may have already filed.

The IRS also started small on purpose — Direct File only widely opened after weeks of limited testing — and exceeded its goal of getting 100,000 users through the pilot, they said, noting that the agency also didn’t have an advertising budget for the program.