Keeping modernization on track

The Internal Revenue Service is in the midst of one of the most protracted of all systems renovations as it modernizes its Master File taxpayer account system.

The Internal Revenue Service must replace its aging tax processing systems, but the agency can’t stop running them while it builds replacements. So the IRS builds new systems while it operates the old systems, and it tries to make sure the new systems work with the old.

The job is “like trying to change the engines on a jumbo jet while it’s in flight, and you don’t have a complete set of blueprints to know how the original engine was put together,” said W. Todd Grams, the IRS’ chief information officer from 2003 to 2006.

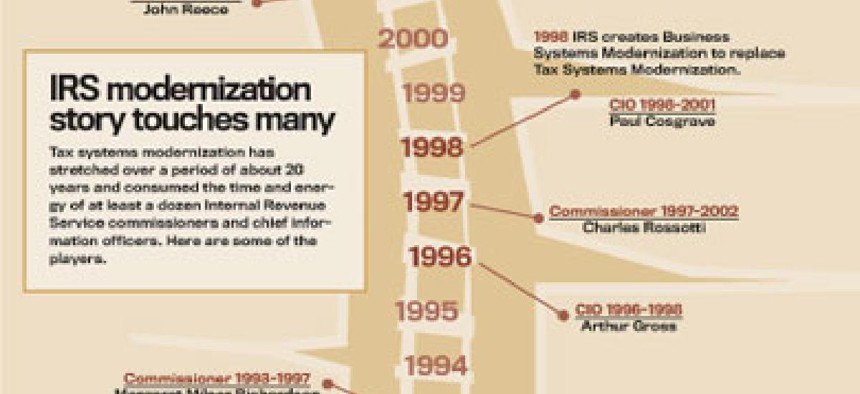

The progress that the IRS has made in modernizing its tax systems has occurred because of a revolution of thinking at the agency and a restructuring of the organization, former IRS officials and modernization experts say. A restructuring of the IRS in 1998 broke down cultural barriers and resulted in centralized operations, a new focus on customer service and, most importantly, a new plan for modernizing the agency’s Master File taxpayer account system.

The Master File system is the central component of the IRS’ tax processing systems. It was designed when John F. Kennedy was president. It’s still coded in the same language in which it was created in 1964. The Master File is a relic of bygone generations of technology, but it maintains information accounts for all taxpayers. In the past, rigidly scheduled updates to the Master File occurred once a week. Before Internet connections let the IRS move information instantaneously, the agency regularly had to transport magnetic tapes containing taxpayer account information to update central data centers.

“It is classic 1960s architecture,” said Tom Lucas, the IRS’ senior adviser for enterprise architecture.

Because the Master File has been around so long, the IRS has added many new systems and connected them to it. Now more than 500 information technology systems interface with the Master File. However, its design is not documented well enough for anyone to know for sure how all the systems connect to it.

The IRS has a complex tax code wrapped around a complex IT environment, said Richard Spires, the agency’s current CIO.

Agency officials have made several expensive attempts to renovate the tax systems. Past endeavors, such as Tax Systems Modernization (TSM), cost billions of dollars but did not improve tax processing.

Most IRS officials — past and present — agree that TSM tried to accomplish too many changes at once. It attempted to change administrative, financial and personnel systems. Its purpose was to modernize the IRS’ core applications and transform the agency into a modern financial institution, said Jim Sheaffer, president of Computer Sciences Corp.’s North American Public Sector.

In 1986, Henry Philcox was the IRS’ deputy commissioner for tax systems modernization. In response to major system failures, he began planning TSM. Philcox, who became CIO in 1990, said one of his priorities was to speed information sharing with IRS employees in the field who needed timely information.

“We had no telecommunications system for data transport,” Philcox said. “We were still flying magnetic tapes [with tax information] on airplanes back and forth across the country to run weekly updates.” Philcox tried to build a Digital Processing System, a new technology then, to create readily accessible electronic documents.

But the Government Accountability Office, then called the General Accounting Office, said the technology was not ready for an organization as large as the IRS, and Congress eventually cut the program’s funding.

Modernization was a tough assignment partially because service centers in the IRS districts operated like autonomous fiefdoms, said James Thompson, assistant professor at University of Illinois at Chicago. IRS employees in each district developed their own software and disregarded agencywide standards.

Sometimes failures occurred, but “by golly, they were very proud that they were able to make changes to that system and do it rather successfully,” Philcox said.

Besides dealing with a difficult agency culture in the mid-1990s, Philcox dealt with lawmakers. He faced members of Congress who had little understanding of IT or the necessary modernizations to the agency’s tax systems. He asked lawmakers not to add spending deadlines to the $800 million they appropriated for improving tax processing.

Philcox said he tried to explain the complexity of buying and installing the right equipment. He remembered his exchanges with former Rep. Jake Pickle, a Texas Democrat who served from 1963 to 1995. Pickle, chairman of the House Ways and Means Committee’s IRS oversight subcommittee, told Philcox he didn’t understand why the IRS could not spend all of that money in a year to buy new computers, and he vowed not to give the IRS funding again.

“I just wrung my hands and said, ‘Oh, my word, how in the world are we ever going to get this done when we’ve got that level of understanding,’ ” Philcox said.

The IRS needed more than a supportive Congress with a clearer understanding of how to proceed toward its modernization goals. In a 1992 report on TSM, GAO said the IRS needed a vision of how it would use technology in the future. In 1995, GAO reached the conclusion that the multibillion-dollar TSM was a failure because it was too ambitious.

IRS officials “had initially taken on the world” without the infrastructure to handle it, said Margaret Begg, assistant inspector general for audits of information systems programs at the Treasury Inspector General for Tax Administration. “TSM was a lesson learned for them.”

The IRS lacked a clear mission with TSM and attempted too much at once. And experts say the agency failed by missing the real problem: the outdated Master File system. It first needed to fix that system.

Given a mandate to recommend changes at IRS operations, the National Commission on Restructuring the Internal Revenue Service studied the agency for more than a year. In its 1997 report, it said the agency’s systems architecture — its business functions, data and technology building blocks — was inadequate. It recommended that top officials at the IRS integrate the agency’s business objectives and information technologies.

The commission also concluded that the IRS commissioner lacked the authority needed to manage the agency’s transformation. Part of the solution was to eliminate the district fiefdoms.

The IRS Restructuring and Reform Act of 1998 changed the agency from top to bottom. Most important, experts say, it reorganized the management structure. Charles Rossotti, IRS commissioner from 1997 to 2002, pushed to centralize management at the IRS. Autonomous IRS districts came under the authority of officials in Washington.

Rossotti then worked to reorganize the agency tax returns into four customer-based segments: wage and investment, small business/self-employed, large and midsize businesses, and tax-exempt and government entities. The change directed the IRS’ attention to the taxpayer customers.

On Jan. 28, 1998, Rosotti told Congress that the IRS would upgrade its technology through central, professional management and common agencywide standards.

He would also study the modernization concept and implementation plan. Under TSM, the IRS left such studies unfinished, a criticism raised in numerous GAO reports.

Rossotti announced that he intended to build partnerships between the IRS’ IT and business units and hire contractors to help with modernization. The IRS could not ignore the expertise it could find in the private sector, he said.

Rossotti combined all of the districts and brought them under one CIO. Previously, introducing new IT systems would take as long as eight years to complete. Rossotti had to gain control of the agency. “But in an organization that has been in existence in that form for over 50 years, [it] wasn’t something you did in five minutes,” he said.

Former IRS CIOs and others say Rossotti was a visionary who set in motion a revolution at the agency.

“He was the guy,” Thompson said. “Rossotti made it happen.”

Systems experts recognized that the IRS had to make two fundamental changes to modernize its tax systems. It had to create a secure infrastructure on which to build Internet applications and improve service, and it had to move taxpayer account information from the Master File and into a more accessible and flexible database system.

The Internet-connected platform has been built, but the process of converting the Master File continues. The IRS replaced a portion of the Master File with its first release of the Customer Account Data Engine (CADE) in 2004. There have been two subsequent releases.

“That couldn’t have happened if Charles Rossotti and his team had not made so much progress on the infrastructure because we were able to build upon that,” said Grams, who was CIO during CADE’s initial release. Grams is now chief financial officer at the National Institute of Standards and Technology.

The IRS has progressed on its conversion of the Master File, but it has encountered problems. Beginning in the early 2000s, the conversion was repeatedly delayed and cost more money than expected. The IRS Oversight Board chided the agency for the problems. Spires said the IRS underestimated CADE’s complexity. It is now reviewing how it estimates costs and introduces new portions of CADE.

Caution is appropriate because the public won’t tolerate IRS errors, said John Reece, the IRS’ CIO and deputy commissioner for modernization from 2001 to 2003. “Remember, this is a zero-defect organization,” Reece said.

The IRS’ multibillion-dollar Business Systems Modernization program, initiated in fiscal 1999, is the agency’s latest attempt to modernize its systems. To date, about $2.1 billion has been appropriated for BSM. The IRS is seeking to spend $167.3 million from the BSM account in fiscal 2007, according to GAO.

The IRS contracted with CSC in 1999 as the prime systems integrator to assist with designing and integrating new information systems to replace the old ones.

The BSM plan encompasses numerous tax administration, internal management and IT infrastructure projects. It expands taxpayer services and improves internal business efficiencies.

It integrates the business side of the IRS with its technology operations.

Many observers say Spires, one of BSM’s leaders, is among the most effective CIOs that the IRS has had. He has a background in IT and private-sector experience, and he has used that experience to advance modernization. For example, he has focused on short-term projects, an industry best practice.

Rather than taking three or four years to deliver a fully developed system, as the IRS has done in the past, the agency now looks for ways to provide a visible return on investment in 12 months. But every short-term project contributes to the IRS’ long-term objectives, Spires said.

The IRS still faces the challenge of changing the jumbo jet’s engines in flight, but Spires said he likes such challenges.

“I came here [for] the challenge of trying to help the IRS modernize its IT systems,” he said.

A 1960s classic

The early 1990s

The turning point

Modernization’s drivers

Business Systems Modernization

A 1960s classic

The early 1990s

The turning point

Modernization’s drivers

Business Systems Modernization