CFPB's Ashwin Vasan: Build teams with 'a passion for doing things differently'

The CIO for the government's youngest agency says that even in start-up mode, building a culture of innovation is tricky.

Like many agencies that have been around decades longer, the Consumer Financial Protection Bureau often attracts top talent by virtue of its mission. Yet as the "new kid on the block," it also has positioned itself as a 21st century agency. Many people -- particularly in IT -- are drawn to the CFPB because of its reputation as the start-up in government.

So as CIOs across the government are saying that agency culture is the biggest barrier to innovation, so how does an agency like CFPB foster culture that is all about innovation?

Ashwin Vasan, CFPB's CIO, told FCW creating that culture of innovation is about bringing people into the agencies who want to be an agent for change.

"Whether inside or outside of D.C., our focus has always been on finding people who know their area of expertise, have a passion for doing things differently and care about our mission," Vasan said. "The key is getting those people in the door. They might have 20 years of experience in the federal government, or be outsiders to the government, maybe a UX designer who has looked at government websites and is interested in improving those design elements for consumers."

Especially in an agency being built from the ground up, bringing in a diverse group is key. At CFPB, Vasan said, there are data scientists, government veterans, software developers, graphic designers and coders, each with different technical skills and backgrounds.

That's not to say CFPB doesn't face the same challenges as other agencies when trying to innovate, however.

Part of the challenge in the federal space is understanding the constraints and still being committed to doing things differently, Vasan said. CFPB, he admitted, is still working to assert itself as a viable agency.

"It's an extremely fast-moving environment—we're managing the expectations of meeting mission needs, and making sure we're building something that's sustainable in the long term," Vasan said. "Delivering quickly in the short term, but also building that foundation."

CFPB was created as a result of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, and is tasked with protecting American consumers. Vasan was named CIO in October 2013, after having acted as a senior advisor to CFPB Director Richard Cordray since June 2011.

In a relatively short amount of time, CFPB has covered a lot of ground technologically: it launched a robust new website, recruited a talented workforce, built a presence on open source repository GitHub, opened up numerous APIs and datasets and developed user-friendly apps and tools for consumers.

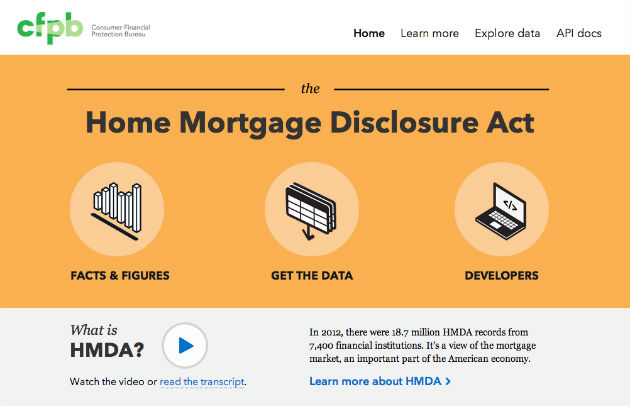

When CFPB was tasked with authority of the Home Mortgage Disclosure Act, or HMDA, the bureau took many steps to improve the data provided to help consumers. It created a mortgage market visualization/data tool on its site, and opened up its HMDA API on GitHub for anyone to access.

Consumer outreach around the Home Mortgage Disclosure Act includes a mortgage market data visualization tool. The agency has also opened up an API for HMDA data.

In addition to full-time staff, the agency has also made full use of its CFPB Technology Innovation Fellows. That program offers a two-year fellowship for software developers, graphic and user experience designers, data specialists and cybersecurity professionals.

The last class of fellows had a hand in creating AskCFPB, an interactive tool that gives users access to consumer and financial data, including more than 1,000 frequently-asked questions; eRegulations, a tool that simplifies and explains regulations; and consumer-friendly designs that have been deployed throughout the bureau.

Vasan recently announced that CFBP is recruiting for its second class of fellows.

And with a workforce that is largely in the field, enabling a mobile workforce is another priority for Vasan. Many of its more than 1,300 employees are not D.C.-based, and the CFPB examination team is entirely remote.

For that reason, Vasan and his team have been working on videoconferencing and other tools to promote collaboration amongst a largely independent working organization.

Despite not being able to always work physically together, Vasan is confident in his colleagues' ability to get the job done. After all, he said, the agency has hired people who are passionate about the mission.

NEXT STORY: Buying agile without jumping through hoops